Handel in buitenlandse valuta

Verken de valutamarkten ter wereld en handel in enkele van de sterkste en meest herkenbare valuta’s uit landen als de VS, het VK, Australië en Canada. Koop, verkoop en verhandel de dollar, het pond, de yen, de euro en anderen.

Krijg toegang tot de Forex-markt met Delta-Trend en ons bekroonde platform. Handel in de meest liquide markt ter wereld en zoek naar kansen in elk valutapaar. Profiteer van een volledig aanpasbare lay-out, meer dan 50 technische indicatoren en de mogelijkheid om rechtstreeks vanuit grafieken te handelen. Handel zowel long als short en geniet van bliksemsnelle orderuitvoering.

Cryptocurrencies beschikbaar voor handel

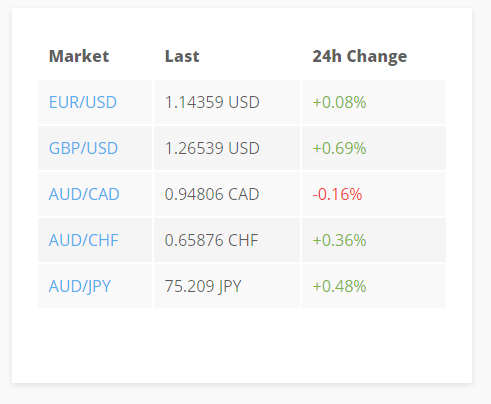

EUR/USD

EUR/USD is de euro, munteenheid van de Europese Unie, verhandeld tegen de Amerikaanse dollar.

GBP/USD

GBP/USD is het Britse pond dat wordt verhandeld tegen de Amerikaanse dollar.

AUD/CAD

AUD/CAD is de Australische dollar die wordt verhandeld tegen de Canadese dollar.

AUD/CHF

AUD/CHF is de Australische dollar die wordt verhandeld tegen de Zwitserse frank.

Waarom u zou moeten overwegen om in buitenlandse valuta te handelen

De valutamarkt is de meest verhandelde en liquide markt die er bestaat en biedt de handel in de nationale valuta van de supermachten van de wereld. Deze landen hebben een belangrijke invloed op het mondiale economische klimaat, en hun valutawaarden correleren met de omgeving en politieke factoren, waardoor forex een belangrijke markt voor handelaren is.

Brede selectie van valuta’s ter wereld

Delta-Trend biedt ’s werelds meest verhandelde forex-valuta’s, waaronder USD, GBP, JPY, EUR, maar ook minder populaire valuta’s, zoals TRY, RUB, HKD en nog veel meer.

Geavanceerde technische analyse

By paying close attention to chart patterns and technical indicators, traders can easily analyse forex market trends and improve their trading results.

Easy for both professionals and beginners

The forex market is very popular for professional traders who know its opportunities, but it is an equally good place to start a trading journey.

Why trade Forex with Delta-Trend

Exciting opportunities

Discover unlimited opportunities in the global forex market. It takes only 40 seconds to sign up and access all available currency pairs on Delta-Trend platform.

Best-in-class trading platform

Become a better trader with built-in charting software that helps to perform technical analysis quickly and efficiently. Take advantage of the professional tools offered on Delta-Trend platform.

Customize your trading interface with features like multi-monitor functionality, a range of integrated dashboard widgets, and 24/7 customer service.

Low trading fees

Save as much of the profits from your trading as possible with Delta-Trend, which offers some of the lowest commission rates in the industry.

How does Foreign Exchange margin trading work?

Margin trading is a process where a trader can borrow funds from Delta-Trend in order to open a larger position than the actual amount of funds deposited. Such trade will only require a fraction of the total position value, known as margin.

If your forex margin trade is successful, you will be able to make more profit than you would without using leverage. However, if the trade is unsuccessful the losses can be magnified too.

You should always consider downside potential and take steps to manage your risk.

The benefits of Foreign Exchange trading with leverage

Magnified profits

When trading foreign exchange on leverage there is the potential for additional profits with the need for less capital in a trade.

Diversification opportunities

Trading forex on margin requires less funds for each individual position, allowing that capital to be further utilized in different types of trades, across all available markets.

Gaining from the market fall

Using leveraged products allows trading on a market that is rising, as well as falling. Traders can open short positions to profit from a market that is declining.

Foreign Exchange leverage trading example

For example, if a trader opens a position in USD/JPY, and it falls 10%, using 5x leverage the same drop becomes a 50% profit. A similar spot trade without leverage would result in only 10% profit.

Disclaimer: Margin trading also comes with inherent risks if the position moves against the trade. You should never utilize 100% leverage and never invest more than you can afford to lose.

How to start trading Foreign Exchange?

What is Foreign Exchange?

The foreign exchange market is the market for global currencies, but what is currency trading? Currency trading is among the most popular markets to trade and the most liquid and well established in the world. That’s because it consists of the most prominent national economies across the globe, and the currencies that represent each region, and the forex market dictates the exchange rate for each and every national currency.

Each nation’s fiat currency is impacted by a number of factors, including supply and demand, national debt, political factors, natural disasters, events, and much more. Because so many different things can affect the price of forex currencies, causing them to fluctuate, each makes for a great asset to trade, and because each country is impacted by its own unique factors, each trading pair behaves differently.

The forex currency market trades 24 hours a day, except for weekends.

How Forex trading works?

Forex currency trading works by taking a long or short position depending on which direction the trader expects the market to move. Using Delta-Trend advanced trading tools and built-in charting software, a trader can plan the perfect entry point or exit via detailed technical analysis, and then put the strategy into practice. Both long and short orders can also be opened simultaneously to take hedge positions and further minimize risk or maximize profit opportunity.

What currencies trade in Forex?

The forex market, short for the foreign exchange market, is the highest volume market in the world, and important enough to set the international exchange rate of all currencies from around the globe.

Each foreign exchange currency is traded by a broker in a trading pair against another forex currency. For example, the United States dollar can be traded in a pair against the Japanese yen. The below guide will briefly outline the benefits of each of the major currency pairs to trade, as well as the benefits of some of the more exotic currency options offered by Delta-Trend .

Major currency pairs to trade

The four major forex currency pairs available for trading include EUR/USD, GBP/USD, USD/JPY, and USD/CHF. The major pairs are all based on the US dollar, which is the currency of the largest economy in the world, and the major reserve currency across the globe. Most assets and markers are priced in USD, making it a natural fit for many of the highest traded forex currency trading pairs.

Exotic currency pairs to trade

Delta-Trend also offers more exotic forex currency pairs, including AUD/CAD, EUR/CHF, GBP/JPY, and many more. In total, Delta-Trend provides traders access to 14 exotic trading pairs in addition to the four major forex currency trading pairs. These more obscure and exotic markets make for a unique trading experience as each currency in the pair reacts to different sets of factors causing price fluctuations.

Open an account now

It’s free to open an account, and there is no obligation to

fund or trade.